What is an exchange-traded fund (ETF)?

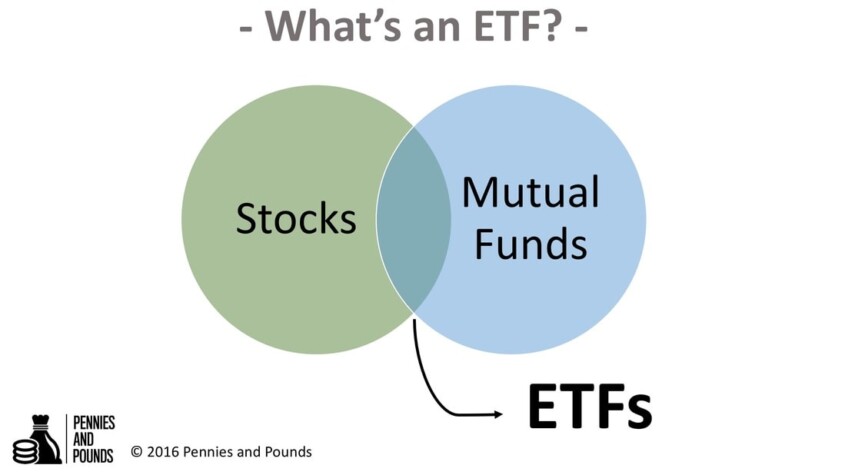

An exchange-traded fund is an investment fund (similar to mutual funds) but can be traded throughout the day with general liquidity (like stocks). In a sense, an ETF combines the best parts of mutual funds and stocks:

- stocks – high liquidity

- mutual funds – easy diversification

ETFs are relatively new – they first appeared in the United States in 1993 and in Europe in 1999. They began as index funds – index funds are investment funds that are created to track indexes such as the Dow Jones Industrial Average (DOW), the S&P 500 Index (SP500), the FTSE in England, or the DAX in Germany. Over time, ETFs have evolved beyond index tracking and now come in a plethora of tilts and styles (eg. US oil, emerging markets, technology, biotech, etc.).

There are other important differences that distinguish ETFs from mutual funds, but they aren’t truly very important to a novice (or even an intermediate) retail investor. If you want to know more about the legal structure of ETFs, you can visit this Wikipedia article for more.

The main thing we should point out is that ETFs are almost like a hybrid between mutual funds and stocks. Mutual funds are usually not as liquid as stocks and can’t be traded throughout the day. Mutual funds are usually priced once a day (at the end fo the day) unlike stocks, which are priced continuously by the market. Stocks are usually very liquid and can be generally bought and sold throughout the day. An ETF combines these two – you can purchase an ETF easily through your online stock broker the same way you would purchase a stock. There generally are no minimums for ETF purchases and it really feels like purchasing a stock.

Since most ETFs are indexed (and not actively managed) fees are generally lower for ETFs – this is an incredibly attractive aspect of ETFs because it is generally believed that active management isn’t worth the fees investors pay for it (most of the time, BUT not all of the time).