Getting to One Thousand – How to Save Your First $1000

Every journey begins with a single step. Have you heard of that saying? You’ve probably heard of it and although it might sound cliche, it is extremely insightful. If you don’t have at least $1000 put away you have not taken your first step on the path to financial freedom – it’s time to take it with the help of Crafting Wealth in this in-depth guide. The first step on your path to financial freedom and wealth is putting $1000 away as a starter emergency fund – that fund will stand between you and the financial emergencies that will come your way in the future. Without even $1000 saved, you are exposed to extreme risk because even a slight financial emergency has the potential to wipe you out financially or put you into debt. Read the piece below for a comprehensive guide on getting to your first $1000 and you’ll be well on your way to financial success and financial freedom.

Don’t Have $1000? You’re in a dangerous situation!

Whether you are 18 or 80, if you don’t even have $1000 in your pocket in the developed world, you’re in a dangerous situation and you must immediately do the things below to build up at least a basic $1000 rainy day fund.A rainy day fund or an emergency fund is a required part for most financial plans because it protects you in various ways. You can read more about why you need an emergency fund in this very comprehensive article that will surely make you look at your finical life in a different way (check this article our immediately after reading this article):Why You Need an Emergency Fund: The Most Complete Explanation Ever

However, if you don’t even have $1000 saved, we can’t yet be concerned with a real emergency fund because you don’t even have a tiny buffer between you and life’s uncertainties and financial storms. An emergency fund will almost always be more than $1000 if you’re an adult with living expenses (and will definitely be more than $1000 if you are running a household), but we must take the first small step, moving you from the absolute nakedness of not even having $1000 saved to putting a $1000 financial blanket over you.Without any money saved in a rainy day fund or emergency fund, you will have trouble handling the following possible financial emergencies:

- flat tire

- car repairs

- medical bills

- loss of income (even for a short period of time)

- appliance repair or replacement

- sick pet

- parking and traffic tickets

- repairs around the house or the apartment

Additionally, without even a bare minimum of $1000 saved, you will likely find it very difficult and stressful to deal with expenses that aren’t emergencies, but that are rare (eg. those that occur once every few months, once every few years, etc.) – expenses such as:

- yearly car registration

- new clothes for the winter

- new clothes for interviews

- new clothes for children before school starts

- birthday, wedding, and Christmas (and other holidays) gifts

- membership fees and dues

If you don’t have $1000 saved, you probably know the above already and you probably already know how stressful life can be without some sort of financial cushion, but we must reiterate it in order to really demonstrate how important it is that you act now and act quickly to put $1000 away.

Once you have your $1000 saved, you will feel much better. Although $1000 isn’t a proper emergency fund for most people, you’ll still have some breathing room in your life once you are able to put away your first $1000 – you’ll have some cash put aside for when life comes knocking on the door. You’ll know that you can handle small financial emergencies easily because you have the money put aside for them. You’ll also feel proud for doing it because getting to your first $1000 (regardless of your age) isn’t an easy task. If you can get to $1000, you can move forward to building up a full emergency fund and then building some wealth for you and your family.

Why don’t you have $1000 already?

If you don’t have $1000 put away already, it’s likely for one of the following three reasons:

- You don’t make enough money

- You spend too much money even though you make enough to already have $1000 put aside

- You recently were dealt a terrible financial blow and were pretty much financially wiped out

First, let’s address the third category – if you recently dealt with a financial emergency that wiped you out financially. That’s a very tough situation to be in. However, if you had an emergency fund before the financial emergency and if you had some wealth built up, you actually did pretty well. Yes, you’re back at square one now, but you have proven yourself capable of building an emergency fund and building wealth. So, you can do it again, even though it may seem incredibly hard now. In a way, we’re not as worried about you as we are with those in the first two categories. So, ask yourself whether or not you were doing well once financially and whether or not your current situation is just because of some finical emergency. If that’s the case, get back up, look into getting some more insurance in place to guard you in the future, and begin anew, with the knowledge that you’re capable of doing what’s right for your finical life. There’s deep dignity in being able to take a hard punch to the chin and having the grit to get back up again – have the grit and get up.

Now, on to the first two categories – these are serious issues because they demonstrate fundamental or structural problems with your finical life – it’s not that you had a run of bad luck. If you’re in the first two categories, some drastic but focused changes will need to be made so that you can get on the right track finically and put some money aside for yourself and your family.

1. Don’t Make Enough Money

This is tough and everyone should understand this. After the Great Recession, the US economy (and generally speaking, the global economy) has recovered, but it has been an unusual recovery compared with other economic recoveries in the last century – it has been a recovery in the stock market and the GDP, but not in employment. Yes, the unemployment rate has dropped, but the definition of the term “unemployment” is very precise and that precision can be misleading when people exit the workforce. We won’t go into the details of how unemployment is measured or the technical definition of the unemployment rate in this article, but it is important to note that just because the unemployment rate has gone down doesn’t mean that things have gotten much better in terms of employment – people might be employed but underemployed and some people might have dropped out of the labor force altogether (and, therefore, wouldn’t be counted as unemployed per the current definition of unemployment in the United States). Those are a lot of words to explain what you probably already know, just because you have a job doesn’t mean it pays enough and doesn’t mean you have enough hours at it to make a good income.

If you don’t have an income at all currently and are on your own (if you’re pursuing some sort of education and are living with parents or other relatives you’re not really on your own yet) then you’ve got a bigger problem than those that are underemployed – you’re not even earning anything. That’s an understandable position to be in – the economy of the United States and much of the Western World has shifted and is continuing to shift towards a more capital-intense knowledge-powered economy that is making many people simply unemployable. What this means is that many people aren’t unemployed because they are lazy or don’t apply for jobs or because they somehow failed to get the right skills – it’s that we’re transitioning towards an economy where there are no right skills for you to have, an economy where not everyone can have a job because there just aren’t that many jobs available. Now, we know it’s a tough situation for many people, but that can’t stop you from doing your best to earn some sort of income and putting some money aside for the future. You cannot afford to be left in the backwash of the transitioning global economy – you must find the energy to do something today to move forward while at the same time creating a gameplan for the future.

Whether you are underemployed or unemployed, you should likely get working right now in some part-time job or freelance gig. The job doesn’t have to be something you see yourself doing one year from now, it just has to be something that can reliably bring in extra cash every week and every month, allowing you to put some money aside to get you to your first $1000.

A Few Potential Side Gigs

Pizza Delivery: This is a slightly old-school recommendation for a part time gig but it can still work in the right situations and for the right people. It doesn’t pay very well hourly, but you have the potential to earn a decent amount in tips if you work in a good area and are personable.

Drive for Uber or Lyft: This seems like the 21st-century version of the pizza delivery job. It’s becoming common knowledge that Uber, Lyft, and other firms are attempting to move away from human-based transportation, so the opportunity to earn money with Uber and Lyft might not exist a decade from now, but you can definitely take advantage of it today as long as your car meets their requirements.

Cashier: This works best for seasonal work – times of the year (usually the holidays) when business picks up and extra workers are temporarily needed. There are a few disadvantages with this type of job, however. You can’t set your own ours and you can’t work extra hours. Freelancing or driving for Uber, for example, you can decide to have an intense two weeks and drive a lot of hours to earn some extra cash quickly – with a typical cashier (or similar) job you just can’t do that and you’ll have to be ok with the money trickling in slowly. Additionally, the pay is likely to be low with few or no opportunities to earn tips.

Upwork: If you have some advanced and in-demand skills, check out Upwork, an excellent way to freelance online. It might take some time to build up your profile so you’ll have to be a bit patient compared to other jobs (you don’t start earning much immediately) but you have the potential to earn a very good hourly wage and you can work from anywhere.

Fiverr: Similar to Upwork, but paying less, Fiverr allows you to freelance and take jobs from anywhere if you have in-demand skills.

If you can get a side job (or two – and possibly three), even temporarily, you should be able to put enough money away every week or every month to build up your first small rainy day fund of $1000. If you’re in this camp, however, you need to make sure to stay vigilant and forward-looking because you don’t want to:

- waste all of the extra money you are earning – the goal is to put it aside

- look up in a year or a few years and still be in these side jobs

- neglect your health or your loved ones – don’t forget to put people over money

The ideal situation is you working now and putting money aside while developing some sort of gameplan to earn more in the future – earn more not just by working more hours but by earning a higher hourly wage. To earn more per hour, you’ll need to improve yourself – you’ll need to improve your technical or job-related skills, your professional skills, and your overall personality. Think about where you want to be in a year and in a few years and move in that direction, getting the necessary skills and experiences so that you can end up in the job you want (and can realistically obtain).

2. Earning a Decent Income but Spending Too Much

If you’re in the camp of people who earn a decent income but who overspend, you’re in the toughest camp because some deep changes will need to be made in order to make financial progress – changes that might take less time than a side job but that are more mentally and spiritually difficult to accomplish and changes that you’ll have to stick with for the long run if you are to permanently improve your financial situation.

What’s a decent income?

Now, by decent income, we don’t mean earning six figures or earning enough money that all financial irresponsibility will be wiped away just by the sheer volume of money coming in. By decent income, we mean an income that is around the median income of your community or state. There is no hard and fast rule for this, but you could consider earning anywhere from 75% of your community’s median income as a decent income that should easily allow you to put away $1000. If your household makes a median income, in the vast majority of cases you should easily be able to have $1000 put away – if you don’t seem to ever be able to do this then it means you are likely consistently overspending and living beyond your means even though your means allow you to live a reasonably comfortable life while still saving for your future and building your financial house.

You Must Cut Out Unnecessary Spending in Order to Save Money

If you’re making a reasonable income and you still don’t have $1000 saved, you must likely cut down on your spending. It’s very difficult to write general statements for a general audience, but it is likely that most readers who earn an income 75% of the median in their communities (or more) and are unable to put away $1000 likely have a problem with overspending and understanding the difference between necessities and luxuries.

It is very difficult to move from a lifestyle of reckless wastefulness to lifestyle of frugality and discipline. Many people try for a little while but then return to their old ways of overspending. It seems that there are underlying reasons for many people’s dysfunctional financial habits that cause them to behave in irrational and self-destructive ways. We won’t go into them here in any depth, but here are a few possible psychological issues or neuroses that potentially cause people to behave recklessly with their money (and overspending is definitely reckless financial behavior):

- Spoiled: Had everything growing up and now finds it difficult to say no to himself or herself

- Raised from Poverty: Grew up in poverty and now with an average income attempts to fill in some sort of internal missing piece by buying “stuff” – interestingly enough coming from poverty also occasionally causes people to behave in the exact opposite way, acting as misers and penny pinchers out of fear of returning to a state of poverty

- Lack of Self-confidence: Low self-esteem and self-confidence surprisingly manifest themselves in people’s finances all of the time through overspending (both on yourself and on others) and an inability to say no with dignity

- Fear of Finances: This is slightly related to the self-esteem issues above, but it’s more about people who don’t feel they can handle their finances well – they mistakenly think they are too dumb to do it or that it’s just not for them

Now, we all feel bad about ourselves at times. We all doubt ourselves at times. We all have occasional fears of being in poverty and many people have been spoiled in certain ways. However, many of these people are still able to live financially responsible lives because they do not allow their internal psychological issues and neuroses to influence their pocketbooks, their bank accounts, and their wealth building programs – they understand that the cost is just too great and that nothing will be improved by mishandling finances. However, handling your finances properly and spending less then you make (living in financial dignity) will allow you to improve both your financial life, your personal life, your professional life, and your internal life – it will make you into a happier and stronger individual.

I know the above is easy to say but hard to do – it’s very hard to overcome yourself and stop misbehaving financially. However, if you are to ever build wealth and live a financially stable and successful life you must begin to improve your interactions with money and your ability to handle it properly. You must begin by saving your first $1000 so that you may go on to amass $10,000 and $100,000 and hopefully much more than that in time. But, you’ll never be able to amass any real and lasting wealth if you are governed by your own psychological neuroses and your momentary whims and desires to spend money on frivolous things when you don’t even have $1000 put away for yourself.

To the Details – Start Putting Away Some Money Every Week

If you put in a concentrated effort into building up your wealth, you’ll be able to save your $1000 in less than a year (and possibly in less than 3 months if you can save more).

Don’t save every month – do it every single week. If you attempt to save every month you might end up at the end of the month with not enough to put away. You will run the risk of not having the needed amount if you do it every single month. However, if you save a bit of money every week, it will be both painless and it will assure that you actually are able to put enough money away. Weekly savings will be relatively painless. Weekly saving doesn’t even require receiving a weekly income – you can be paid biweekly or once a month and still successfully save every week because you can save a very small amount every week (an amount possibly less than the cost of a single skipped restaurant meal).

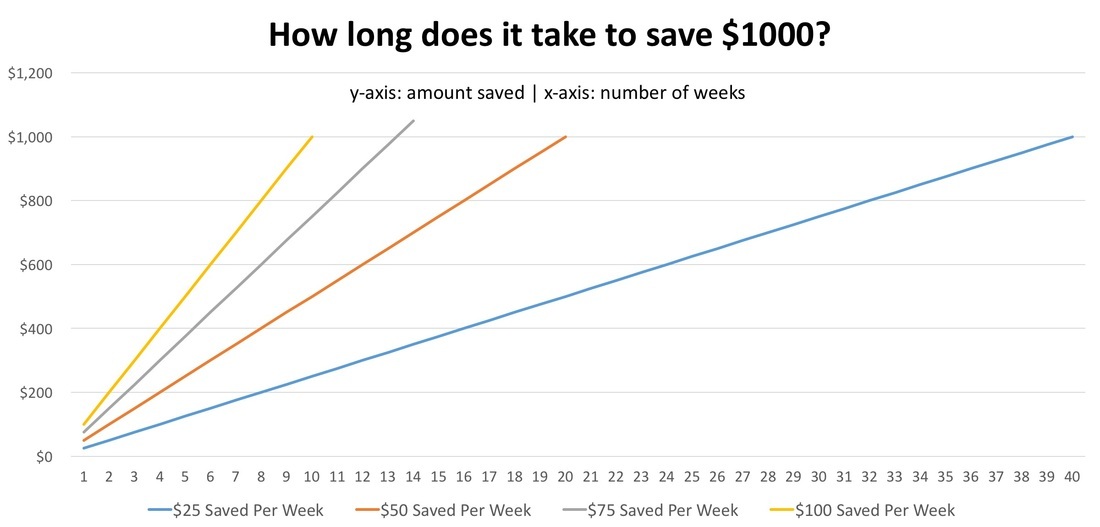

Take a look at the graph below to see how long it will take you to reach $1000 by saving either $25 per week, $50 per week, $75 per week, or $100 per week. Obviously saving more is better, but even if you can put away $25 a month, you will have your $1000 in less than one year – you will transform your financial house from a desolate and empty lot to a lot with a slowly building solid foundation (a foundation on which you will continue to build upon).

Additionally, you will want to create a monthly budget. This is tough and you can expect that you’ll be way off on your budget for the first couple of months, but things should get easier if you keep at it. In creating a budget, plan on where each dollar will go to next month and do your best to stick to it. Next month, before creating another budget, evaluate the success and failures from the previous month. If you’re married or financially intertwined with a partner, make sure to create the budget together. Not both of you have to put in equal effort (some people are more financially savvy or more interested in personal finance than others) but both of you should have a seat at the table and both of you should have a say into how the budget is determined if you are to do this in a proper and overall healthy way.

Takeaways:

1. If you don’t have $1000 saved up, you’re in a dangerous situation because you are exposed to both financial emergencies and one-off expenses (those expenses that are not monthly but that instead occur yearly, every few years, or once in a lifetime). Without having even a very basic $1000 rainy day fund, you are in a very precarious situation which will prevent your from building wealth – if you can’t even save $1000, how will you save $10,000 or $100,000 or build lasting wealth. This should motivate you to put in the work and make the necessary sacrifices to get to your first $1000. The good thing is that $1000 isn’t very hard to save up – as the above graph demonstrates, even putting away an extra $25 per week will get you to your $1000 in a lot less than a year.

2. Depending on your current situation (not earning enough vs. big spender), you will have to approach things as described above. Be aware that the problem with your current financial situation isn’t just the numbers, but it is with your heart and your soul also – never forget that who we are inside will manifest itself in our finical life also. Be courageous as you make the necessary external (getting an extra job or building a budget) and internal (understanding why you overspend if you’re in the second category) changes to start on the path to financial success and finical freedom.