Saving Money is Not Enough – You Must Invest It

Saving money is not the same as investing money. Although to invest money, you must first save it, saving and investing are two very separate things.First you must earn an income. You can earn an income by selling your hourly labor or you might earn an income in other ways (eg. investment income, residual income from intellectual property, etc.). Regardless of how you earn an income, you must decide what to do with the money that is coming in. A prudent person will never spend his or her entire income – they will instead make sure to live below their means in order to be able to save a portion (hopefully a substantial portion) of their income for various things:

an emergency fund for financial emergencies

a cash reserve for expenses that don’t occur monthly (eg. once a year, once a month, once in a lifetime)

investing money in order to grow it – this is where most of your money will go

You save money in order to invest, but just because you save money doesn’t mean you are investing it or that you’re an investor. Investing money is a very specific action that you take with your money in order to grow it in a calculated way. Read our article on what constitutes proper investing to get a good understanding what investing really is:

Are you investing or speculating? (The Real Definition of Investing)

If you put money into your checking account, into your savings account, under your mattress, or in your backyard, you are not investing it – you are merely saving it. Even though a savings account pays you a rate of interest, it doesn’t qualify as proper investing because the rate of return is certain at the outset and because the goal of such a product isn’t to grow your money but to keep it safe. Additionally, this will almost never outpace inflation – you’ll lose purchasing power every year on average. For more, read the article above on what constitutes proper investing.

So, why do we have to invest?

You must invest because saving is not enough – if you are a salary earner or a small business owner or self-employed (if you’re never going to strike it rich but instead rely on a monthly income), you will never become very wealthy by just saving money every month unless your income is incredibly high. You must invest because of simple mathematics – because the numbers don’t make sense otherwise.

A Simple Example of the Power of Prudent Investing

Let’s imagine two households: Household A and Household B. Each of our households earns a decent income although Household A earns more. Both of our households are hard-working and both have goals for the future – they both want a nice nest egg to retire on and to enjoy.

Household A

- Saves $60,000 per year for 30 years at a return of 0%

- So, $60,000 x 30 = $1.8 million

- Household A obviously is able to save a lot of money – $60,000 per year (or $5,000 a month)

- How much money must Household A make and how much must it sacrifice in order to have its $1.8 million in 30 years? It seems like Household A must either make a ton of money or must sacrifice incredibly to reach its $1.8 million in 30 years.

Household B

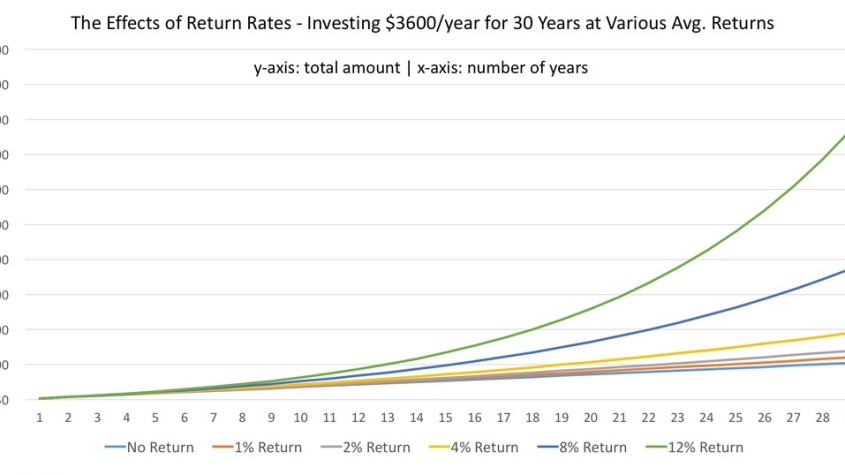

- Saves $7200 per year for 30 years at a return of 12%

- Per the above graph, we can see that Household B will have almost $1.8 million also (simply multiply the outcome for 12% by 2)

- Household B obviously invests a much smaller amount of money every year than Household A – a huge difference. In fact, saving $60,000 would be almost impossible for most households but saving $7200 is well within the realm of possibility (it’s just $600 per month vs. $5000 per month).

- It’s important to note that we used a (non-inflation-adjusted) return of 12% – that’s a pretty solid return but definitely possible to have over a 30 year period if you invest aggressively and correctly

So, we see that Household A and Household B end up with about the same amount of money in 30 years but had vastly different approaches – Household A just saved money while Household B not only saved, but also invested.

The reason Household B did comparatively better than Household A (it saved almost 10 times less per year but achieved the same results) was because Household B worked for its money and then it put that money to work – Household A just worked for its money.

Work for Your Money – Then Have Your Money Work for You

Investing allows your money to work hard – investing allows your money to grow and compound. By just saving your money and not putting it into ventures or schemes that will allow it to grow, you are relying only on your hard work to get you to your financial goals. Financially wealthy and wise people, however, realize the power of money – they see its power to earn a return and to allow that return to compound over time. The compounding that occurs over time is like a snowball rolling downhill, picking up ever-increasingly large amounts of snow as it continues.

Takeaways:

1. Saving alone isn’t usually enough to reach your financial goals unless your income is sufficiently high and you have the willingness and ability to save very large amounts of money (to sacrifice a lot) – investing is a much easier and much more effective strategy for building wealth.

2. The advantage of investing is simple – with investing your money works for you. With saving only, however, your entire nest egg is dependent on your ability to save. By investing, you are allowing your money to earn a return and the compounding of that return beautifully increases your wealth over time.