Keep Your Emergency Fund in These 3 Places

Your emergency fund is protection against life’s financial uncertainties. The typical rule of thumb says that you should have 3-months to 6-months of living expenses in your emergency fund. That rule of thumb balances the cost of not having money in the markets with the benefit of a rainy day fund provides – namely, insurance against life’s financial storms. Of course, some situations vary and might call for a larger emergency fund, but I would caution against going below 3-months of living expenses.But where do I keep my rainy day fund?

Having 3-months to 6-months in living expenses leads to a further question: where should you keep your rainy day fund? This is an important question because your emergency fund is a significant amount of money and requires prudent care in order to protect it while still having the liquidity a proper emergency fund requires.Don’t Just Keep Your Emergency Fund in One Place

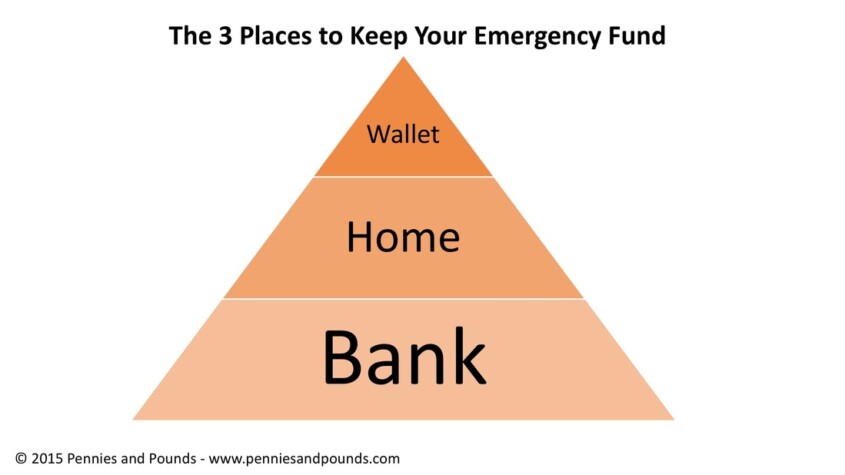

My advice is to keep your emergency fund in more than one place. You want your overall rainy day fund split up into 3 categories:

- Cash in your wallet or purse

- Cash at home

- Money in the bank (or banks)

By keeping it in three places, you are properly protecting yourself against emergencies. Not every emergency happens during bank operating hours and you might not have access to an ATM. You should have a small portion of cash in your pocket and a small portion of cash at home with the rest in a liquid account at a bank (or more than one bank – one a brick and mortar bank and one an online bank for the higher interest rate).

1. Cash in your wallet or purse

Emergencies can happen anywhere. You might have a situation where cold hard cash is required (although that is becoming less and less of a worry as the world digitizes and even small businesses can easily accept credit cards). For those rare or hopefully nonexistent occurrences, having a small percentage of your rainy day fund in your wallet in the form of cold hard hundred dollar bills and twenty dollar bills might prove useful.

You obviously don’t want to have a significant amount in your wallet or purse for the obvious reason that it could be stolen or lost. You should be wise and prudent in how you keep this money. Put it in a more secret place in your wallet or purse if such a place exists.

I don’t have a hard and fast percentage rule for how much you should keep in your wallet or purse, but it should probably be less than 5% of your total rainy day fund.

2. Cash at home

You want to also have some cash at home. I don’t have a hard and fast rule for what percentage of your emergency fund you should keep at home, but it should probably be less than 25% of your total emergency fund.

Keeping cash at home is a good idea for various reasons. First, you might need to get your hands on cash right away without having to make a trip to the bank or an ATM. Additionally, there might be a natural, societal, or political disaster that prevents you from leaving the vicinity of your residence for various reasons (eg. safety, inability to get on roadways, injury, etc.). In this situation, cash at home might prove very useful should there be opportunities to purchase basic necessities within your neighborhood or to transact in other beneficial ways.

3. Money in the bank (or banks)

The majority of your emergency or rainy day fund should obviously be kept in a bank. There the money is physically safe and FDIC insured (assuming you are within FDIC Insurance limits). We now have a few options for exactly how to keep the money in a bank.

Brick and Mortar + Online

You should do both. Keep a portion in your brick and mortar bank for quicker access and keep the rest in an online bank. An online bank has two benefits:

First, it allows you to separate from the money a bit more but still gives you quick access when needed. This separation prevents you from using your rainy day fund for unnecessary things or non-emergencies. The separation gives you a bit more time to think about whether using the money is actually required.

Second, you will most likely get a higher interest rate at an online bank. The purpose of your rainy day fund isn’t to obtain a return on your capital (it’s to protect your wealth and your other investments from liquidation in a financial emergency), but it doesn’t feel pleasant when you’re earning abysmally low interest rates. Keeping a portion of your emergency fund in an online bank might remedy this.

Savings > Checking

Keeping the money in a savings account that is linked to your checking account is preferred. The savings account will earn a higher interest rate and it will allow some sort of separation from your daily transactional account. A dedicated savings account (both at your brick and mortar bank and your online bank) is a good idea because you’ll know exactly how much money is allocated for your rainy day fund and you won’t get it mixed up with your transactional accounts or with other savings accounts (eg. other liquid cash, down payment, imminent tuition payments, etc.).

What if I have more than the FDIC Insurance limits?

If you are in the pleasant situation of having more money in your saving account than is covered by FDIC Insurance limits (currently $250,000 in each bank for individual accounts – visit the FDIC website for the full information on this), you’ll want to split up your money and put it into different banks so that you are below the limit at each bank. I would recommend being careful and doing your research with this in order to make sure all of your rainy day fund is covered by FDIC Insurance.

If you have so much money that it is not feasible to put your entire rainy day fund in various banks (eg. an emergency fund in the millions or tens of millions of US dollars), then you might have to purchase less liquid instruments such as US Treasuries in order to keep the remainder of your rainy day fund, but won’t go down that path here. However, it is unlikely that your rainy day fund will be that large because your rainy day fund should cover 3-months to 6-months of living expenses, not income. Even if you have a very high income, it is unlikely that 6-months of living expenses will be more than a couple of million dollars.